HealthManagement, Volume 17 - Issue 1, 2017

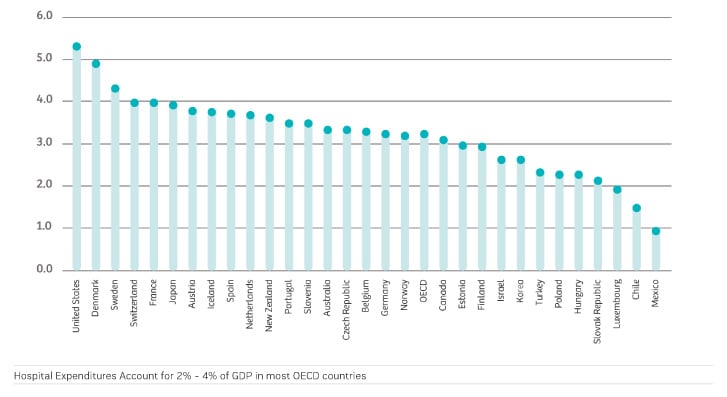

Aging Populations and Cuts in Public Healthcare Funding are Driving new Levels of Competitive Pressure

As global populations continue to age and governments continue to cut back on public healthcare funding, the ability to strengthen clinical capabilities, patient outcomes, and process efficiency is rapidly becoming the battleground on which competitive strategies are being fought. Find out what can be learned from the U.S. market, the largest, most competitive healthcare market in the world, to strengthen competitiveness within a given healthcare system.

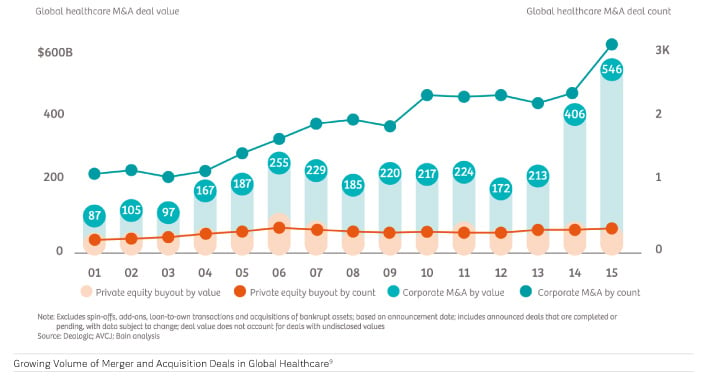

The Size Counts

Becoming larger – whether by acquisition, merger, or entering into joint ventures – confers a number of competitive advantages, including the ability to leverage economies of scale, strengthen bargaining position with payers, and provide additional services through the verticalization of managed care programs along the supply chain.1 It’s little wonder that mergers and acquisitions in the healthcare sector are growing every year.2 Both horizontal and vertical consolidation are up significantly. Surveys show that U.S. hospital managers see the verticalization of outpatient services and post–acute care as a way to improve patient outcomes and increase market share and revenues.3 The most common objectives of healthcare partnerships in the United States are to: increased market share, improved operational cost efficiencies, improve financial stability, expand geographical coverage, and strengthen payer negotiations.

It Pays To Be Where the Patients are

The U.S. healthcare market is moving quickly toward greater overall outpatient care. Retail and walk-in clinics offer convenient and accessible primary care as an affordable alternative to emergency room visits. Demographic targets call for half of all Americans to have a CVS Minute Clinic within 10 miles of home.4 Following their success in the primary care market, retail clinics are now looking to expand further into chronic and specialized care. Rather than see this as a reason for worry, far-looking hospital managers see an opportunity. Many providers, for example, have already entered into partnership agreements with players such as CVS and Walmart. The establishment and development of outpatient networks is particularly attractive for healthcare providers.

Leave the Customer Satisfied

In the U.S., since 2012, a growing portion of hospital reimbursements has been tied to Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) scores. HCAHPS performance will determine up to 2% of all Medicare payments for hospitals and health systems by 2017.5 The projection is that this amount will increase in the future. Investment in modern medical technology can make a particularly important contribution to patient satisfaction. Rapid and accurate diagnoses based on technology can enhance the competitiveness of an institution. Innovations in IT infrastructure contribute to patient satisfaction as well. While patient satisfaction is a clear marker for competitiveness, it’s important to weigh the need to keep patients happy against the need to keep them healthy and the need of institutions to remain financially sound.

Smart Personnel Management Is a Smart Move

Nearly 70% of health workers worldwide are concentrated in Europe and North America.7 Still, even in industrialized countries, skilled healthcare professionals are hard to find. Not surprisingly, tech solutions are already proving their value. Effective hospital staff management today requires that all processes be optimized and calls for improved individual skills management and investments in safe, user-friendly technology. Easy-to-use tech solutions help reduce training costs, enable better staff rotation, and reduce the need to hire overspecialized experts for individual silos in the care delivery chain.

Cultivate Referrals

Practicing active referral management is crucial for a hospital’s ability to influence patient flow. Referring physicians should be viewed and treated as valuable partners. Refferers may be broken down into categories such as frequent refferers, first time refferers, local referrers or external referrers. The most successful hospitals attempt to cultivate an ongoing relationship with all referring physicians in the catchment areas.

Invest in Success

Without adequate profit margins to generate surplus for investment purposes, hospitals enter a dangerous downward spiral: necessary investments fail to occur, which decreases competitiveness, and in turn decreases surplus, preventing investment. Investing in modern IT, staff training, high-performance equipment, modern premises, and even contemporary room amenities is the price of entry for competing in most markets. Leasing or rental-based opportunities are effective solutions to limited investment resources. Overall, healthcare institutions are using smart finance to improve planning, acquire state-of-the art technology, and manage cost-per-outcome in order to offer high-quality care and service to patients.

In a Nutshell:

Six areas of focus most likely to strengthen competitiveness

Size

Becoming larger – whether by acquisition, merger, or entering into joint ventures– confers a number of competitive advantages:

• Ability to leverage economies of scale

• Strengthened bargaining position with cost payers

• More services in managed care programs through verticalization along the supply chain

Customer Proximity

The trend toward greater overall patient care is growing. Retail and walk-in clinics offer convenient and accessible primary care as an affordable alternative to emergency room visits. Furthermore, establishing outpatient networks, verticalization of outpatient services and post-acute care, and telemedicine to widen geographic coverage approaches are on the rise.

Patient Satisfaction

Investment in modern medical technology can make a particularly important contribution to patient satisfaction. Rapid and accurate diagnoses based on technology can enhance the competitiveness of an institution. Innovations in IT infrastructure contribute to patient satisfaction as well. This includes measures that relieve staff workload, freeing up time for more patient interaction.

Staff Allocation

Effective hospital staff management today requires that all processes be optimized and calls for improved individual skills management and investments in safe, user-friendly technology. Easy-to-use tech solutions reduce training costs, enable better staff rotation, and reduce the need to hire overspecialized experts for individual silos in the care delivery chain.

Referral Base

Hospitals can best remain competitive with referrers through referrer surveys that continually solicit feedback on an institution’s strengths and weaknesses.

Useful criteria include:

• Satisfaction with patient care

• Collegiality

• Professional cooperation

• Admissions management / appointment scheduling

• Discharge procedures

Ability to Invest

Leasing or rental-based opportunities are effective solutions to limited investment resources. They help hospitals avoid large capital investments and provide funding based on readily calculable operating costs, which can focus on actual usage – and hence on positive cash flow.

References:

1 HealthLeaders Media: Another Study Links Hospital Mergers and Acquisitions to Higher Prices [Internet] 2016 March 28, cited 2016 June. Available from: www.healthleadersmedica.com/finance/another-study-links-hospital-mergershigherprices. Full text of study available at: http://www.kellogg.northwestern.edu/docs/faculty/dafny/price-effects-of-cross-market-hospital-mergers.pdf

2 Bain & Company: Global Healthcare Corporate M&A Report 2016 [Internet] Cited 2016 June. Available from: www.bain.de/Images/BAIN_REPORT_HEALTHCARE_MA.pdf

3 Bees, J: Intelligence Report: The Outpatient Opportunity-Expanding Access, Relationships and Revenue [Internet] 2016 January 7; cited 2016 June. Available from: http://www.healthleadersmedia.com/quality/intelligence-report-outpatientopportunityexpanding-access-relationships-and-revenue

4 Sussman, A.: What’s Next for MinuteClinic; CVS Health [Internet]; cited 2016 June. Available from: www.cvshealth.com/thought-leadership/expertvoices/whats-next-for-minute-clinic

5 Betbeze, P, HCAPS: Making a Difference While there is Still Time (Internet); HealthLeaders Media 2016 November 11; cited 2016 June. Available from: www.healthleadersmedia.com/marketing/hcahps-making-difference-whiletheres-still-time

6 The Beryl Institute, Patient Experience Journal (Internet); cited 2016 June; Available from: www.pxjournal.org

7 World Health Organization: The World Health Report 2006: Health Workers (Internet); cited 2016 June. Available from: www.who.int/whr/2006/06_chap1_en.pdf

8 Beaulieu, D., AMGA 2016: Linking Patient Experience to the Bottom Line [Internet] 2016 March 17; cited 2016 June. Available from: www.healthleadersmedia.com/physician-leaders/amga-2016-linking-patientexperience-bottom-line?page=0%2C1

9 Bain & Company: Global Healthcare Corporate M&A Report 2016 [Internet] Cited 2016 June. Available from: www.bain.de/Images/BAIN_REPORT_HEALTHCARE_MA.pdf